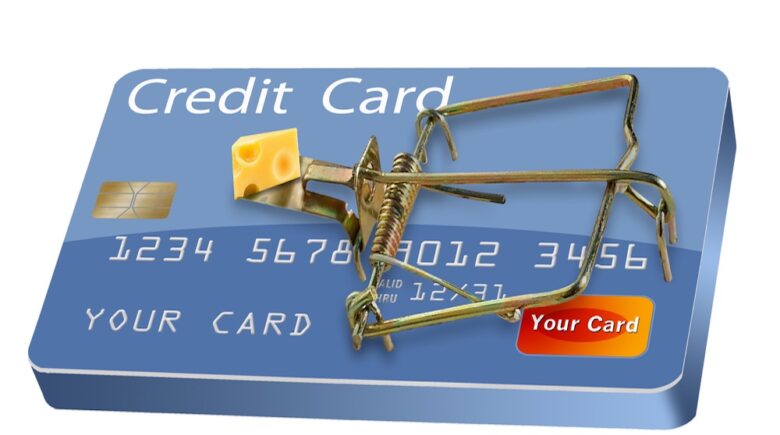

Credit card rewards programs promise a tantalizing deal: spend money and earn points, miles, or cash back that you can use for travel, merchandise, or statement credits. For many millennials navigating their financial journey, these programs seem like a no-brainer way to maximize every purchase. However, the reality often tells a different story. What appears to be free money can actually become a financial trap that costs you more than you’ll ever earn back. Understanding the psychology behind rewards programs and recognizing when points-chasing becomes counterproductive can help you make smarter financial decisions in an increasingly digital payment landscape.

The Hidden Cost of Chasing Rewards

The credit card industry has perfected the art of making rewards feel irresistible. Banks and fintech companies invest millions in sophisticated algorithms and behavioral psychology to design programs that keep you swiping. According to recent data from the Consumer Financial Protection Bureau, Americans now hold over $1 trillion in credit card debt, with rewards programs playing a significant role in driving spending behavior. The promise of earning points creates a psychological phenomenon where consumers perceive purchases as “less expensive” because they’re getting something back.

Furthermore, the structure of rewards programs often encourages unnecessary spending. Many cards offer bonus categories that rotate quarterly or require activation, pushing cardholders to track and optimize their purchases constantly. This gamification of spending transforms routine financial decisions into a points-earning competition. Consequently, you might find yourself choosing more expensive options simply because they earn more rewards, even when a cheaper alternative would serve you just as well.

Moreover, the math rarely works in your favor when you factor in the complete picture. Most cash-back cards offer between 1-2% back on purchases, while travel rewards cards might promise more value but come with restrictions and blackout dates. If you’re carrying a balance, even occasionally, the interest charges quickly eclipse any rewards you’ve earned. Credit card interest rates currently average around 20-24% APR, meaning a single month of carrying a $1,000 balance could cost you $20-40 in interest—far more than the rewards you earned on that spending.

When Points Programs Drive Overspending

Research consistently shows that credit card users spend more than cash users, and rewards programs amplify this effect. A study published in the Journal of Consumer Research found that consumers spend up to 83% more when using credit cards compared to cash. Additionally, rewards programs create what behavioral economists call “pain decoupling”—the separation between the pleasure of purchasing and the pain of paying. When you’re earning points, your brain focuses on the reward rather than the actual cost, making it easier to justify purchases you wouldn’t otherwise make.

The subscription economy has made this trap even more dangerous. Many rewards cards now offer elevated earning rates on streaming services, food delivery apps, and online shopping platforms. While these bonuses seem beneficial, they can normalize excessive spending on convenience services. Instead of cooking at home, you might order delivery more frequently because you’re earning 4x points. Rather than watching free content, you might subscribe to multiple streaming platforms to maximize your rewards category. These small decisions add up quickly, turning your rewards card into an overspending enabler.

Similarly, the rise of digital wallets and one-click purchasing has removed friction from the buying process. When your rewards credit card is saved in Amazon, Apple Pay, or other platforms, making purchases becomes effortless. This convenience, combined with the dopamine hit of earning rewards, creates a perfect storm for impulse buying. Financial technology has made spending easier than ever, but it hasn’t made it any smarter. The key is recognizing when convenience crosses the line into financial harm.

Breaking Free from the Rewards Mindset

Escaping the rewards trap requires a fundamental shift in how you think about credit card benefits. Instead of viewing rewards as “free money,” consider them a small discount on purchases you were already planning to make. This mental reframing helps you avoid the justification trap where you convince yourself that earning rewards makes unnecessary purchases worthwhile. Track your spending for a month without considering rewards, then calculate what you actually earned—the results might surprise you.

Additionally, evaluate whether annual fees make sense for your spending patterns. Premium rewards cards often charge $95 to $695 annually, promising enhanced benefits and higher earning rates. However, unless you’re a frequent traveler who maximizes every perk, you’re likely paying more in fees than you’re receiving in value. Many no-annual-fee cards offer solid rewards without the pressure to spend enough to justify the cost. Honest assessment of your actual usage patterns, rather than aspirational ones, leads to better card choices.

Finally, prioritize debt elimination over rewards optimization. If you’re carrying any credit card balance, your first financial goal should be paying it off completely. The interest you’re paying dwarfs any rewards you might earn. Once you’re debt-free, you can use rewards cards strategically—paying the full balance every month and earning points only on planned purchases. This approach lets you enjoy the genuine benefits of rewards programs without falling into the overspending trap that credit card companies count on.

The Future of Rewards Programs and Consumer Protection

Regulatory bodies are beginning to scrutinize how credit card companies market rewards programs. The Consumer Financial Protection Bureau has increased oversight of practices that may mislead consumers about the true value of rewards. Nevertheless, the burden still falls primarily on consumers to understand these programs and use them wisely. As fintech continues to evolve, we’ll likely see more sophisticated rewards structures that further blur the line between beneficial and manipulative.

Looking ahead, some innovative financial technology companies are developing tools that help consumers track whether rewards programs actually benefit them. These apps analyze your spending patterns, calculate the true value of your rewards after accounting for fees and interest, and suggest whether you’d be better off with a different card or payment method. Embracing these tools represents a smart way to leverage technology in your favor rather than letting it work against you.

Ultimately, the credit card rewards landscape will continue evolving, but the fundamental principle remains constant: you can’t earn your way to wealth through credit card points. Building genuine financial security requires spending less than you earn, saving consistently, and investing wisely. Rewards can be a nice bonus when used strategically, but they should never drive your purchasing decisions. By maintaining this perspective, you can enjoy the benefits of rewards programs without falling into the trap that costs far more than you’ll ever save.

Credit card rewards programs aren’t inherently bad—they’re simply tools that can work for you or against you depending on how you use them. The key is maintaining awareness of the psychological tricks that make these programs so appealing and ensuring that your pursuit of points never overshadows sound financial decision-making. Before making any purchase, ask yourself whether you’d buy it without the rewards incentive. If the answer is no, then those points are actually costing you money, not saving it. By approaching rewards programs with clear eyes and disciplined spending habits, you can enjoy the genuine benefits they offer without sacrificing your long-term financial health.

References

- Consumer Financial Protection Bureau. (2024). “Credit Card Market Report.” https://www.consumerfinance.gov/

- NerdWallet. (2024). “The Psychology Behind Credit Card Rewards Programs.” https://www.nerdwallet.com/

- Journal of Consumer Research. (2023). “Payment Method and Consumer Spending Behavior.” https://academic.oup.com/jcr