A FICO rating is a mathematical evaluation of the financial soundness of an individual. This score depends on the data in the leaser’s records and the way that it matches your record. The least complex credit scoring framework is the FICO score, made by Fair Isaac Corporation, presently claimed by TransUnion. FICO scores are determined from the data in customers’ credit reports, including their record adjusts and installment history. Here we will examine how the credit scoring framework work.

1. How The Credit Scoring System Works

Credit scoring frameworks work by ascertaining a solitary number addressing a singular’s reliability. This number is typically called a “FICO assessment.” A financial assessment can go from 300 to 850, with bigger numbers demonstrating better reliability. While there are a few different scoring frameworks, a large portion of them integrate data from at least one essential sources: the buyer’s credit report, openly available reports, for example, liquidation filings, credit agency refreshes on new records opened, and installments made on existing records. The data accumulated from these sources is incorporated into at least one scoring models and afterward doled out a mathematical worth in light of the singular’s credit report information.

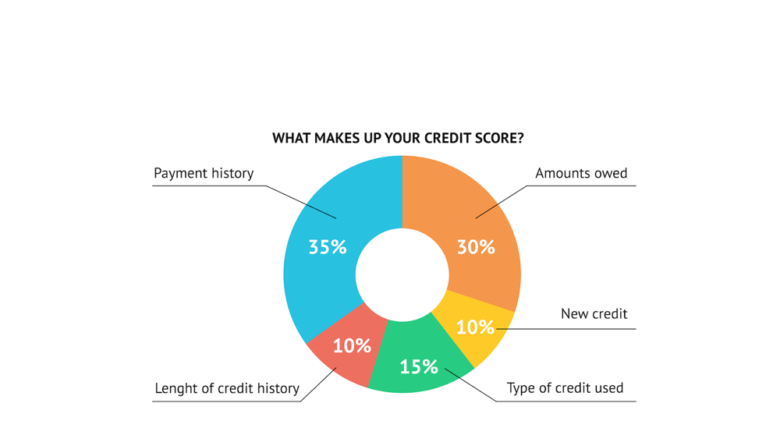

2. Financial assessment Formula

Credit scores are determined utilizing an equation that thinks about three principal factors: how much obligation you owe, how long you’ve held those obligations, and the kind of credit you are utilizing. How much obligation you owe is the most basic variable in a FICO rating. This decides the size of your monetary commitment to the loan specialist and how much cash you want from them. The period of time you have had your obligations likewise influences your FICO rating. The more you’ve had any obligations, and the bigger those obligations are corresponding to the sum owed, the higher your financial assessment. This equation has been created to anticipate the probability that an individual will reimburse their obligations. It doesn’t consider the individual’s pay or their capacity to reimburse the obligation. It just considers how much obligation that they have and how lengthy that obligation has been outstanding.

3. Parts of Your Credit Score

The report will contain different data about your acknowledge, for example, how much obligation you owe, the amount of obligation you possess, how much your lenders are owed, and the time allotment you have had credit. The most basic data in your report is how much time you have had credit. This is known as the “record as a consumer.” It will likewise contain data on whether you are a sensible gamble for future acquiring. Since this score depends on your past activities, it will be impacted by what occurs in the future.

4. Factors That Can Affect Credit Scores

Many elements can influence an individual’s FICO assessment. These incorporate the age of the individual; the age of their most seasoned account (assuming they have mutiple) and how lengthy it has been just getting started; how much obligation owed on each record; the timeframe between accounts being opened; whether the record has been settled completely or just somewhat; how long it required for a record to be paid off totally; and whether there are any neglected bills actually owed on a record. Different variables that can influence a financial assessment incorporate the quantity of Mastercards or advances an individual is conveying. The more cards or advances an individual has, the lower their financial assessment is probably going to be. This shows they are owing debtors and will most likely be unable to take care of the exceptional balances.

5. How Your Credit Score Is Affected By Your Credit History

The sort of credit you have likewise assumes a part in your FICO assessment. The more extended and all the more frequently you utilize various sorts of credit, the higher your score will be. For instance, assuming you are attempting to get a home loan interestingly, your score will mirror your capacity to oversee obligation. However, assuming you currently own a home and have laid out a fantastic history with banks, your score will mirror that information on the most proficient method to oversee obligation. Credit agencies likewise consider whether leasers have sued you in situations where there was insufficient cash owed on the record (for instance, assuming an organization has left business). This question is classified “judgment” or “shame” on your credit report.

6. The most effective method to Improve Your Credit Score

It is difficult to further develop your FICO rating on the off chance that you don’t have one in any case. You should begin by getting a duplicate of your credit report from the customer announcing offices. It is fundamental that this report incorporates your records in general and data, regardless of whether it is negative. When you have these reports, actually take a look at each record to check whether there are any blunders in the data gave. Assuming you have a low score, there are ways of further developing it. Here are a few hints: cover your bills on time; don’t open an excessive number of new records immediately; keep old Mastercards or credit extensions open as opposed to shutting them; don’t close any records except if they have a remarkable equilibrium; don’t matter for a great deal of new credit at the same time; and, on the off chance that you really do have any significant bearing for new records, ensure they’re portion accounts (not spinning lines of credit).

Credit scoring is a continuous interaction that can be utilized to assist you with understanding your FICO assessment. Credit scoring frameworks are accessible across different enterprises, including finance, protection, government, and retail. Banks and Visa organizations use credit scoring to decide if to give you an advance and at what loan fee, while insurance agency use it to choose whether or not to protect you. Credit scoring is additionally involved by managers in the recruiting system and via landowners while deciding if to lease you a condo. Monetary wellbeing is critical to generally speaking wellbeing, and credit scoring is an instrument that can be utilized to show both your monetary wellbeing and how well you deal with your money.