Assuming you’re hoping to fabricate areas of strength for a score, you’ve come to the perfect locations. In this blog entry, we will examine 8 hints that will assist you with accomplishing your objective. Having a decent FICO rating is significant for some reasons. It can assist you with getting endorsed for a credit, lease a condo, and even find a new line of work. Follow these tips and you’ll be en route to an ideal financial assessment right away!

- Check your credit report consistently

A FICO rating is significant on the grounds that it is one element that moneylenders consider when you apply for an advance or Visa. The higher your score, the more probable you are to be supported for an advance with good terms. A decent FICO assessment can likewise set aside you cash since it can assist you with fitting the bill for lower loan fees. Checking your credit report is the most effective way to keep steady over your financial assessment. By regulation, you are qualified for one free credit report from every one of the three significant credit agencies consistently. You can demand your report on the web, by telephone, or via mail. It’s smart to check your report like clockwork so you can get any mistakes or negative data that might be hauling down your score. Assuming that you find any off base data, you can debate it with the credit agency.

- Make each of your installments on time

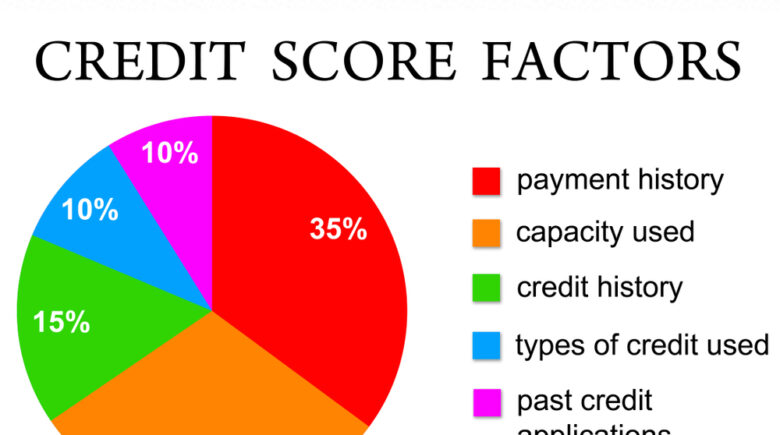

A decent financial assessment is fundamental if you have any desire to fit the bill for an advance, get a lower loan fee, or lease a condo. Installment history is one of the fundamental factors that decides your FICO assessment, so making each of your installments on time, each time is significant. Assuming you’re stressed over neglecting to cover a bill, set up programmed installments. Like that, you should rest assured that your bills are generally paid on time. Remember that late installments can remain on your credit report for as long as seven years, so it’s ideal to keep away from them please. By making these strides, you can further develop your financial assessment and partake in the many advantages that accompany having great credit.

- Keep your Visa adjusts low

Your FICO assessment is one of the main proportions of your monetary wellbeing, and a major variable in deciding if you can meet all requirements for advances or credit extensions. One of the main variables in your FICO assessment is your credit usage proportion – this is just the level of your all out Mastercard adjusts that are exceptional at some random time. A lower credit usage proportion demonstrates that you are dealing with your obligation capably, and as a rule’s, ideal to keep this number underneath 30%. To keep a decent proportion, it’s critical to be aware of the amount you owe and make a point not to maximize your cards. By taking care of your equilibriums every month or causing customary installments when they to do go more than 30%, you can guarantee that you keep steady over this indispensable part of your generally speaking monetary wellbeing. So assume command over your credit today by watching out for that extremely significant usage proportion!

4. Use a blend of various sorts of credit

Moneylenders like to see that you can oversee various kinds of credit mindfully before they give you an advance. This is on the grounds that it shows them that you are probably going to make your installments on time and in full. Having a blend of various sorts of credit in your name is one method for exhibiting this. For instance, you could have a rotating credit extension, for example, a Visa, and a portion advance, for example, a vehicle advance. Overseeing both of these mindfully will show banks that you are fit for dealing with various sorts of credit items. Furthermore, having a blend of credit types can likewise assist with further developing your FICO assessment. So assuming you’re hoping to get an advance soon, consider expanding your credit portfolio. It could wind up aiding you in additional ways than one.

- Apply for new credit just when important

With regards surprisingly score, each time you apply for an advance or another credit extension, your score takes a little yet perceptible hit. While these hits might appear to be immaterial at the time, they can truly accumulate over the long haul, adversely affecting your general FICO rating and making it more challenging to fit the bill for advances and different types of credit from here on out. Along these lines, it is ideal to possibly apply for new credit when you truly need it. For instance, you ought to never apply for another card since there is a tempting sign-up reward or rewards program. All things considered, center around applying for credit extensions that are really important to guarantee that your generally monetary wellbeing isn’t undermined by superfluous applications. Thusly, you can assist with keeping your credit sound and stay away from any pointless difficulties that can crash your monetary objectives.

- Keep old records open

Shutting an old credit record can really hurt your FICO assessment. This is on the grounds that it brings down your general credit limits, which thus raises your credit usage proportion. If you would rather not continue to utilize an old record, you can basically leave it open and latent.

7. Use a got charge card if fundamental

In the event that you have terrible credit, you will most likely be unable to fit the bill for a conventional Mastercard. For this situation, you can utilize a got charge card all things being equal. A got charge card expects you to put down a money store that fills in as your credit limit. This store is refundable in the event that you close your record and cover off your equilibrium.

- Screen your FICO rating

The most effective way to further develop your FICO assessment is to monitor it basically. There are at least one or two different ways you can do this. You can check your credit report routinely (as we examined in tip #). You can likewise pursue a free credit observing help, like Credit Karma or Credit Sesame. These administrations will advise you of any progressions shockingly score so you can make a move in like manner.

By following these tips, you can fabricate an ideal FICO assessment instantly! Simply make sure to check your credit report routinely, make every one of your installments on time, and keep your equilibriums low. On the off chance that you do these things, your FICO rating will work on quickly.